ACCOUNTING

- Administrative management.

- Accounting management.

- Preparing your payment files.

- VAT tax return.

- Social Security return.

- Closing annual accounts.

The accounting is managed internally by graduate accountants in order to ensure it always complies with Spanish corporate and tax law. The tariff range is from € 100 to € 250 per month.

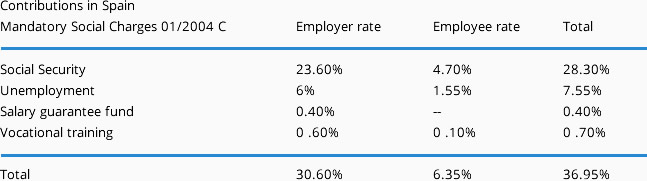

Social charges in Spain

Company tax

Between 25% and 32.5% in company tax according to the size of the business.

SMEs (companies with a turnover under 8 million euros) are taxed at the rate of 25% on the first 120,202 euros of profit and at 30% above that figure.

Do not hesitate to contact us: we will do our utmost to provide you the best advice according to your needs and to prepare a customized estimate for you.

Creation of your Web Site

Multiple language showcase: French, Spanish and Catalan.

WEB START PACK: for presentation internet site.

Specific, effective design to suit your image, careful ergonomics, referencing optimisation … The Web START PACK is the solution par excellence to get your activity ahead on the Internet.

- Up to 5 web pages (home and presentation, your services or products, contact page and site map)

- Design, logo, presentation photos and videos

- Hosting for 1 year

- Choice of domain name

- E-mail address

- Placement on the main search engines (Google …)

- Traffic statistics

- Maintenance

- Total discounted price for our clients : € 690